Types of Accounts: Classification of Accounting, Personal, Impersonal

For example, rent account, salary account, electricity expenses account, interest income account, etc. The accounts used in a company’s accounting system are set out in its chart of accounts, which provides more details than the financial statements. Accounts related to expenses, losses, incomes and gains are called nominal accounts. Important to know about Real Accounts – In spite of the fact that “debtors” are assets for the company, they continue to be classified as personal accounts. This is because ‘debtors’ belong to individuals or entities and personal accounts specifically serve the purpose of calculating balances due to or due from such 3rd parties. We gather and convert all the daily transactions into financial statements, balance sheet, income statements, and cash flow statements.

Types of Accounts: Modern Classification

Rather than listing out each type of utility expense in your Expense category, you can use utility sub-accounts to group them under Utilities. This shows you exactly how much money you’re spending in utilities. Rather than listing each transaction under the above five accounts, businesses can break accounts down even further using sub-accounts. Here are two great resources to familiarize yourself with the classification of accounts.

Journal Entries: Recording Business Transactions

Therefore, these standards are not applicable to Micro, Small and Medium size Non-company entities. However, if there are any such transactions, these entities shall apply the requirements of the relevant standard. To increase revenue accounts, credit the corresponding sub-account.

- Any dividend received from oil company would be termed as dividend income rather than dividend revenue.

- All kinds of expense account, loss account, gain account or income accounts come under the category of nominal account.

- A few examples of real accounts are facets of business like cash, land plant, and machinery, examples of personal accounts are like Preeti, Pankaj examples of nominal accounts are like salaries, wages, sales, and purchase.

- What’s more, it’s the difference between the separate accounts of your assets and liabilities.

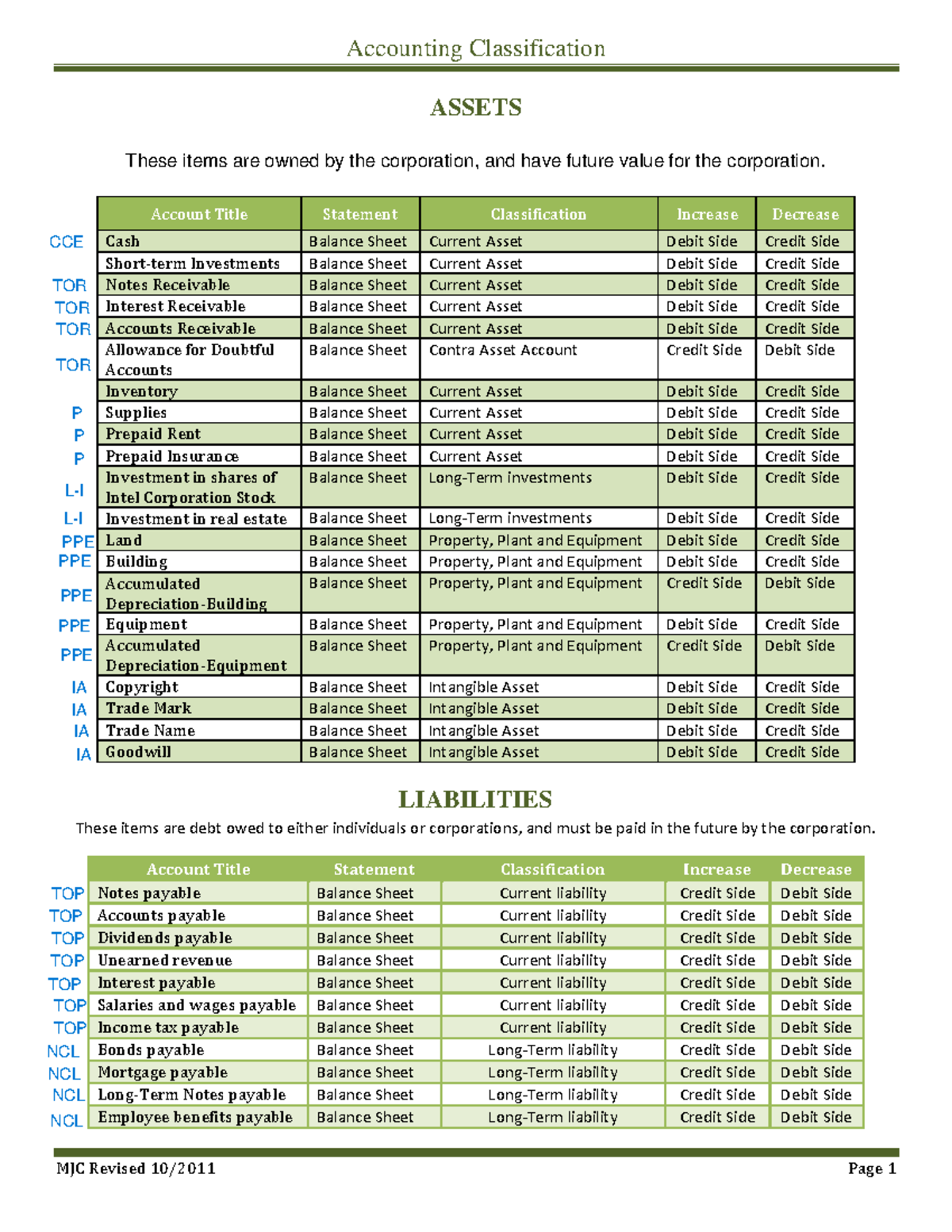

How does a liability account differ from an asset account in accounting?

Any resource expended or service consumed to generate revenue is known as expense. Examples of expenses include salaries expense, rent expense, wages expense, supplies expense, electricity expense, telephone expense, depreciation expense and miscellaneous expense. To reflect this transaction, credit your Investment account and debit your Cash account. Increase (debit) your Checking account and decrease (credit) your Inventory account.

There are mainly three subfields of accounting, such as Cost Accounting, Management Accounting, and Financial Accounting. Type – Cash A/c is a Real account, Discount Allowed A/c is a Nominal account, and Unreal Co. The entry acts as a counterweight and is made to reverse or offset an entry on the other side of an account. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Ask Any Financial Question

Hence it is really very important for every firm or business to maintain accounts. This section is dedicated to the practice of the three types of accounts in accounting. Practising this will help you gain a better understanding of the subject. The dictionary meaning of the word ‘nominal’ is “existing in name only“ and the meaning is absolutely true in the accounting terms as well.

Land, deposits, investments, cash in hand, cash at the bank, and other types of real accounts are examples of real accounts. Once you understand how debits and credits affect the above real accounts, it will be easier to determine where to place your sub-accounts. what is unearned revenue top faqs on unearned revenue Getting familiar with how debits and credits affect the different types of real accounts is important. Liabilities are obligations or debts payable to outsiders or creditors. The title of a liability account usually ends with the word “payable”.

Any dividend received from oil company would be termed as dividend income rather than dividend revenue. Other examples of income include interest income, rent income and commission income etc. The businesses usually maintain separate accounts for revenues and all incomes earned by them. Understanding the various types of accounts in accounting is vital for accurate financial reporting, analysis, and decision-making. Proper classification of accounts allows businesses to assess their financial health and identify areas for improvement. In the Indian context, familiarizing oneself with the types of accounts, their purposes, and their relationships to the accounting equation can help businesses and individuals navigate the complex financial landscape.

For instance, one of the most common accounts is the company checking account. Transactions such as paying bills decrease this account and making deposits increases the account. Assume an ending balance of $1,000 from last month in your company checking account. When you write a check for rent in the amount of $110, you subtract that from the balance. When you make a cash sale in the amount of $500 and deposit the cash into the bank, you increase the balance in your company records. These rules may seem simple, but they are essential for accurate financial reporting.

(b) MSMEs that are otherwise not exempted from applying this standard [refer note 2(A)(ii)] may not comply with paragraphs 121(c)(ii); 121(d)(i); 121(d)(ii) and 123 relating to disclosures. The terms ‘Small and Medium Enterprise’ and ‘SME’ used in Accounting Standards shall be read as ‘Micro, Small and Medium size entity’ and ‘MSME’, respectively. Further, the terms Level II, Level III and Level IV entities used in Accounting Standards shall be read as ‘Micro, Small and Medium Sized Entity’ and Level I entity shall be read as a ‘Large’ entity.